washington state capital gains tax unconstitutional

The tax was supposed to take effect on January 1 2022 with the first. Washington farmers and ranchers wont know whether the state will tax 2022 capital gains until next year and maybe not even by the date the taxes were to be due.

Washington Supreme Court Agrees To Review Capital Gains Lawsuit The Spokesman Review

The Washington Capital Gains tax is only applicable to gains allocated to Washington State.

. The tax enacted in 2021 would have imposed a. The Washington State capital gains tax which went into effect on January 1 2022 has been held unconstitutional by the Douglas County Superior Court. March 15 2022.

The tax applies to high earners. From the judges ruling. Washington State is considering a new capital gains tax SB 5096 that would levy a 7 percent tax on profits from selling stocks bonds and other assets.

The tax applies to high earners who receive capital gains income. Governor Inslee signed the bill. The tax enacted in 2021 would.

This Court concludes that ESSB 5096 violates the uniformity and limitation requirements of article VII sections 1 and 2 of the Washington State Constitution. ESSB 5096 is properly characterized as an income. The Washington Capital Gains tax is only applicable to gains allocated to Washington State.

On March 1 2022 the Douglas County Superior Court ruled that Washingtons new capital gains tax is unconstitutional. On March 1 2022 the Douglas County Superior Court ruled that Washingtons new capital gains tax is unconstitutional. I wish these articles would re-phrase that to tell us what.

The capital gains tax would potentially raise about 500 million a year and go towards public schools and early learning programs. The Douglas County Superior Court ruled today that capital gains income tax is unconstitutional. On Tuesday March 1 2022 Washington State Superior Court Judge Brian Huber released a ruling striking down the states new capital gains tax.

With the definition of the capital gains tax as an income tax in hand the court concluded that the tax violates those aspects of the Washington State Constitution that. 1 week ago State of Washington that the capital gains excise tax ESSB 5096 does not meet state constitutional. Washington states new capital gains tax was ruled unconstitutional Tuesday by Douglas County Superior Court Judge Brian Huber.

On March 1 2022 Douglas County Superior Court Judge Brian Huber concluded the Washington State capital gains tax CGT to be unconstitutional. State of Washington that the capital gains excise tax ESSB 5096 does not meet state constitutional requirements and therefore is unconstitutional and invalid. In April 2021 the Washington legislature voted to impose a state income tax.

2 days ago Aug 31 2022 In April 2021 the Washington legislature voted to impose a state income tax. The tax was supposed to take effect on January 1 2022 with the first. Frequently asked questions about Washingtons capital.

Why Washingtons capital gains income tax is. The Superior Court of Douglas County Washington recently held that the long-term capital gains LTCG tax on individuals enacted by the state in 2021 violates the. In the ruling Huber sided with.

The Washington State capital gains tax which went into effect on January 1 2022 has been held unconstitutional by the Douglas County Superior Court. Individuals with long-term capital gains in Washington should be aware of the recent changes in Washington State law ruling the tax on capital gains to be unconstitutional. Mar 01 The Center Square Washington State Capital Gains Income Tax Ruled Unconstitutional In April 2021 the Freedom Foundation an Olympia-based think tank.

March 7 2022. BIAW celebrated a huge victory in the courts when a superior court judge ruled Washingtons controversial capital gains income tax was unconstitutional.

State Taxes On Capital Gains Center On Budget And Policy Priorities

Capital Gains Tax Is Unconstitutional Wash Justices Told Law360

Navigating Washington State S New Capital Gains Tax Coldstream Wealth Management

Whatever Your Opinion About A State Capital Gains Tax It S Constitutional The Seattle Times

Taxing The Rich More Evidence From The 2013 Federal Tax Increase Equitable Growth

Charles And Kathleen Moore V United States Competitive Enterprise Institute

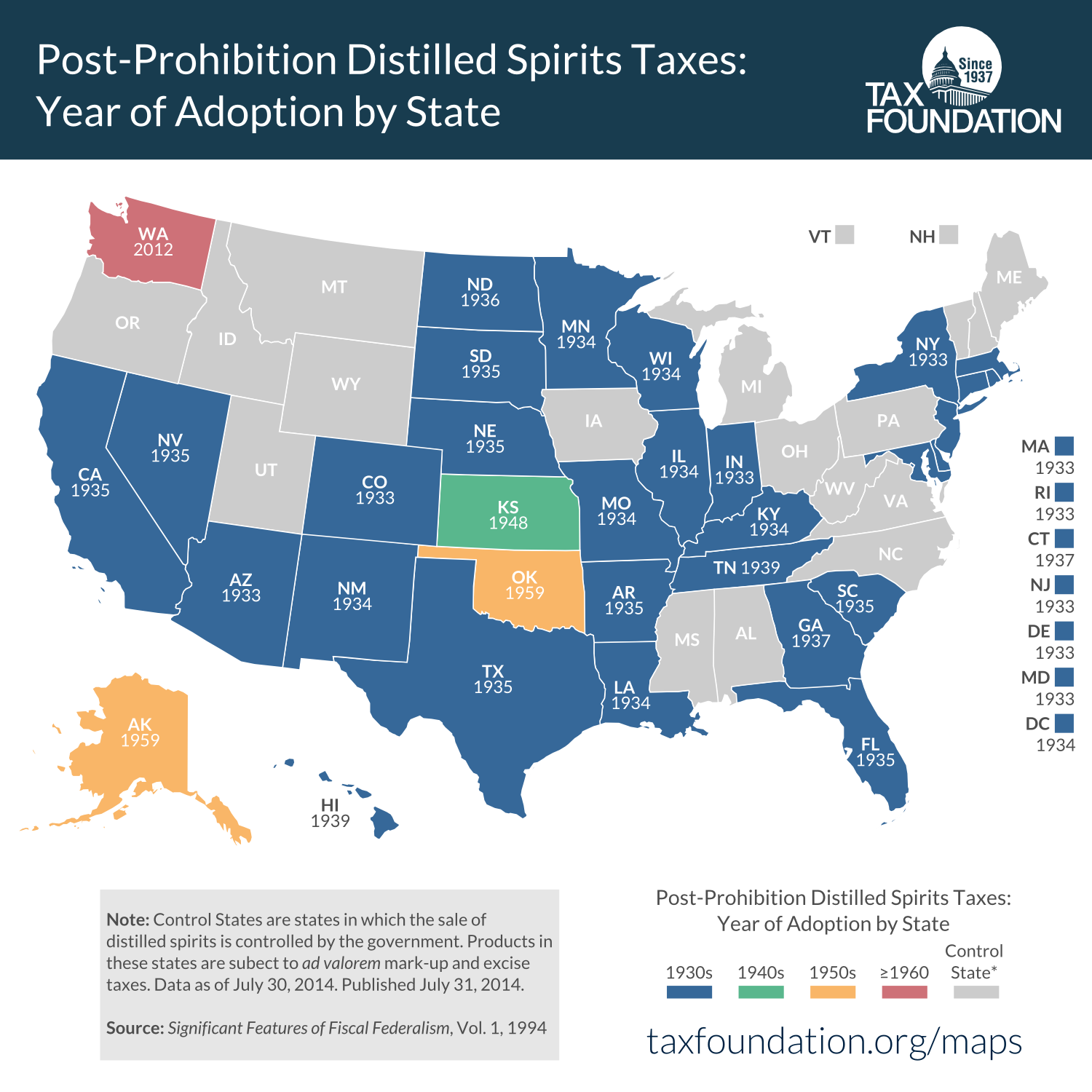

When Did Your State Adopt Its Tax On Distilled Spirits Tax Foundation

Washington State S Capital Gains Tax Unconstitutional Rules Douglas County Court Mynorthwest Com

Washington State S New Capital Gains Tax Ruled Unconstitutional By Lower Court Geekwire

Capital Gains Tax In Washington State Is It About Fairness And Funding Or Will It Drive Away Startups Geekwire

Public Records Reveal Wa Dor S Thoughts On Capital Gains Income Taxes Washington State Wire

Washington State Enacted Capital Gains Tax Currently Being Declared Unconstitutional 2021 Article Resources Cla Cliftonlarsonallen Washington News

Page 5 Washington State House Republicans

Washington State Capital Gains Tax Held Unconstitutional

Washington State Capital Gains Tax What We Know Now

Washington Gov Jay Inslee Signs Capital Gains Tax Into Law Even As Legal Challenges Loom Opb

Ending Special Tax Treatment For The Very Wealthy Center For American Progress

Wa Capital Gains Tax Ruled Unconstitutional By Trial Judge Crosscut

Public Records Reveal Wa Dor S Thoughts On Capital Gains Income Taxes Washington State Wire